Table of Contents

- Introduction

- Multi-Generational Living

- Co-Buying with Friends

- Rise of Build-to-Rent Communities

- Sustainable and Energy-Efficient Homes

- Smart Home Integration

- Demographic Shifts in Homeownership

- Affordability Challenges

- Conclusion

The landscape of homeownership is shifting dramatically as modern families evolve and adjust to new economic realities, lifestyle preferences, and demographic changes. Today’s buyers are exploring innovative ways to secure a place to call home—whether through multi-generational living, leveraging technology, or embracing co-ownership. For those seeking opportunities in competitive markets, such as Los Altos homes for sale, understanding these trends is crucial to making informed decisions.

Whether families are integrating smart features, looking for sustainable options, or navigating fluctuating interest rates, today’s market demands adaptability and awareness. Buyers must assess which trends align with their values, needs, and long-term objectives while balancing financial constraints and growth opportunities.

Multi-Generational Living

One of the most prominent shifts in home-buying patterns is the return of multi-generational living. Data from the National Association of Realtors reveals that 17% of home purchases in 2024 were for households intending to accommodate more than one generation—an upward trend not seen in over a decade. Economic hardships, an aging population, and the desire to share caregiving responsibilities make multi-generational setups increasingly attractive. Modern homes are being built or retrofitted with separate living spaces, additional suites, and accessible features to support this trend.

Co-Buying with Friends

With home prices at historic highs, co-buying with friends is gaining popularity, particularly among millennials and younger Gen Xers. Group purchases enable individuals to pool down payments, share monthly expenses, and relieve some financial pressure while still building equity. However, these arrangements also require careful planning. Prospective buyers are encouraged to consult with legal experts and create written agreements that outline decision-making protocols, exit strategies, and each party’s responsibilities before finalizing a purchase.

Rise of Build-to-Rent Communities

Not everyone is ready or able to take on a mortgage, fueling the emergence of build-to-rent (BTR) communities designed for long-term renters. These purpose-built neighborhoods primarily consist of single-family homes available exclusively for rent, offering amenities such as playgrounds, gyms, and shared workspaces. BTRs combine the space and privacy of homeownership with the flexibility and lower upfront costs of renting, attracting families who want a suburban experience without a lifelong commitment. These developments are surging in suburban and metropolitan areas where affordability is a challenge for first-time buyers.

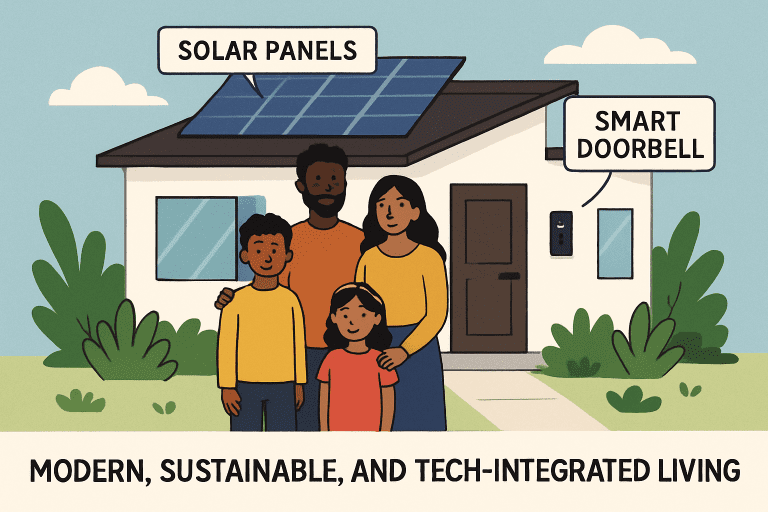

Sustainable and Energy-Efficient Homes

Buyers are also increasingly prioritizing sustainability when searching for homes. Features such as solar panels, high-performance insulation, and energy-efficient HVAC systems not only reduce utility costs but also appeal to environmentally conscious consumers. According to the U.S. Department of Energy, energy-efficient homes can save homeowners up to 30% on annual energy bills—making green living both a practical and ethical choice. Furthermore, sustainable upgrades can enhance long-term property value and future-proof homes against stricter regulations or rising energy prices.

Smart Home Integration

Modern buyers expect convenience, security, and efficiency, driving increased adoption of smart home technology. These homes may feature amenities such as automated lighting, advanced security cameras, smart thermostats, and voice-activated assistants. Integrating technology can increase a property’s desirability and is often seen as a worthwhile investment.

Demographic Shifts in Homeownership

The demographic profile of the average homebuyer has shifted in recent years. The age of first-time buyers now averages 40—significantly higher than a decade ago. Only 24% of buyers in 2024 are purchasing their first home, indicating that younger generations are entering the housing market later, often due to factors like student debt, delayed family formation, and stricter lending standards. Households seeking stability, space, and investment potential are increasingly comprised of older buyers or dual-income families who have established more robust financial foundations before purchasing.

Affordability Challenges

Despite a robust market, affordability is one of the most serious challenges facing aspiring buyers. The median U.S. home-sale price reached $383,725 in 2024, compounded by mortgage rates averaging 7.1%. These high costs have led to decreased homeownership rates among younger adults, who are increasingly choosing to rent for longer or explore alternative ownership options, such as co-buying or BTR communities. Experts encourage buyers to look for assistance programs, consider fixer-uppers, or focus on up-and-coming neighborhoods to overcome these hurdles.

Conclusion

Navigating the diverse landscape of today’s real estate market demands greater awareness and flexibility from buyers. As multigenerational living, sustainability, and smart technology become increasingly prevalent, prospective homeowners must assess which trends align with their long-term objectives. Staying informed about the latest shifts helps families make sound, forward-thinking decisions—laying a foundation for lasting security, comfort, and value in their next home.